Cynical Capitalist

The portfolio, snapshots of memorabilia and artifacts in the collection

2008 Global Financial Crisis

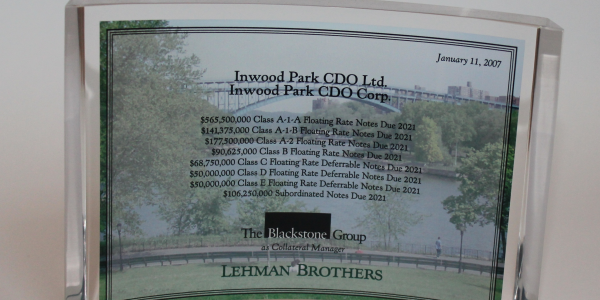

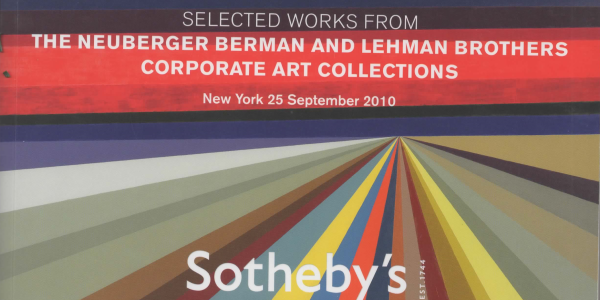

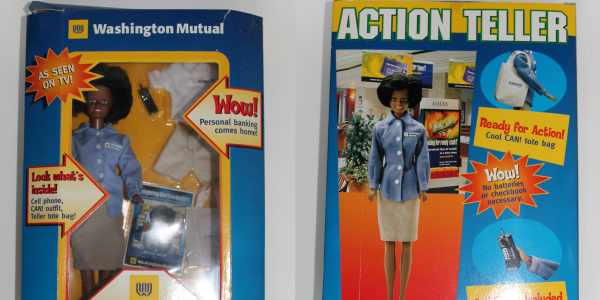

In 2008, a series of bank and insurance company failures triggered a financial crisis that effectively halted

global credit markets and required unprecedented government intervention. Fannie Mae and Freddie Mac were both taken

over by the government. Lehman Brothers declared bankruptcy on September 14th after failing to find a buyer, Bear Stearns followed suit. Bank of America

agreed to purchase Merrill Lynch and American International Group (AIG) was saved by an $85 billion capital injection

by the federal government. Shortly after, on September 25th, JP Morgan Chase agreed to purchase the assets of

Washington Mutual (WaMU) in what was the biggest bank failure in history.

The crisis has its roots in real estate and the subprime lending crisis. Increases in housing prices coincided

with the investment and banking industry lowering lending standards to market mortgages to unqualified

buyers allowing them to take out mortgages while at the same time government deregulation blended the lines

between traditional investment banks and mortgage lenders. Real estate loans were spread throughout the

financial system in the form of CDOs and other complex derivatives in order to disperse risk; however, when

home values failed to rise and home owners failed to keep up with their payments, banks were forced to

acknowledge huge write downs and write offs on these products.