Cynical Capitalist

The portfolio, snapshots of memorabilia and artifacts in the collection

1997 Asian and Russian Crises

Between June 1997 and January 1998 a financial crisis swept the "tiger economies" of South East Asia.

Over the previous decade Thailand, Malaysia, Singapore, Indonesia, Hong Kong, and South Korea, had grown their

Gross Domestic products between 6% to 9% annually, earning the "Asian miracle" moniker. However,

in 1997 one country after another crashed, local stock markets and currency markets imploded. When the dust

started to settle in January 1998 the stock markets in many of these states had lost over 70% of their value,

their currencies had depreciated against the US dollar by a similar amount, and the once proud leaders of

these nations had been forced to go cap in hand to the International Monetary Fund (IMF) to beg for a

massive financial assistance.

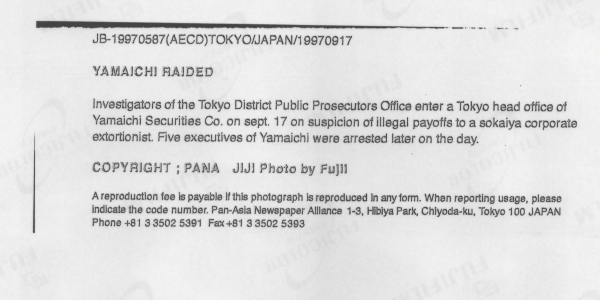

Among the notorious victims of the crisis were LTCM of the US and Yamaichi Securities of Japan:

LTCM or Long-Term Capital Management L.P. was a hedge fund management firm based in Greenwich, Connecticut

that utilized absolute-return trading strategies (such as fixed-income arbitrage, statistical arbitrage, and pairs trading)

combined with high financial leverage. It was notoriously founded by Nobel Prize winners such as Robert Merton (autograph)

and collapsed on September 23, 1998 when 14 financial institutions sponsored a $3.6 billion recapitalization (bailout) under

the supervision of the Federal Reserve