Cynical Capitalist

The collection, memorabilia from some of the defining moments of Capitalism

Panics & Bank runs

Bank runs (when a large number of customers withdraw their deposits from a financial institution at the same time) and their associated banking panics were common occurrences in the early days of capitalism. The 19th century was particularly affected by such panics, and the legacy of these crises resulted in the creation of the FDIC and its eventual role in providing insurance of deposits.

Pyramid Schemes, Ponzi Schemes

Before Madoff did it on such large scale to contribute to the 2008 recession, others had played on the greed of investors and amassed fortunes by promising otherwolrdly returns to their backers, funded by the evergreen inflow of new money. In the 1920's Charles Ponzi invented the "genre" and personified the get rich quick scam

Economic Darwinism

Either not keeping up with evolution of their markets or getting killed by competitors, some companies suffer the fate of dinosaurs. Once mighty, entire industries or iconic companies have gone extinct or nearly so without much of a fighting chance.

Fraud and accounting scandals

Behind every corporate scandal stand trusted executives. Accounting scandals have taken many forms, from misusing funds, overstating revenues or assets, to understating expenses or liabilities, but the most fascinating scandals have often stemmed from misdeeds far beyond creative accounting, such as traders vaporizing billions of dollars in poor investments and companies mixing with bad politics.

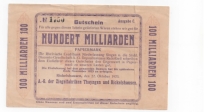

Hyper-Inflation and Fiat Currency

In economics, hyperinflation occurs when a country experiences very high, accelerating, and perceptibly "unstoppable" rates of inflation. Countries that moved away from the gold standard and other commodity-backed currencies, towards a fiat currency system are therefore exposed to the threat of hyperinflation reaching astronomical magnitudes.

Product Failures and Blunders

Innovation is risky business. Introducing a new product to grow a market, making a strategic product development decision to overtake competitors, or changing a business model to revitalize a flattening growth trajectory are major events with lasting consequences. In the past 100+ years, as competition intensified in every industry, a handful of products and decisions stand out by their incredibly negative outcomes, sometimes bringing an entire corporation to the brink of failure.

Bubbles & Manias

Economic bubble and speculative manias are considered the paragon of capitalism's excesses. Fittingly they were also the first negative outcome generated by the societal shift and the first bubbles from the 17th century still serve as templates to assess our more recent, and arguably more complex, economic crises.

Modern Crises

The modern era of capitalism has been marked by the true global nature of its crises and the technology enabled speed at which economies fall...

Stock Market Crashes

Stock market crashes capture headlines as much as the imagination as they boil down usually much larger economic conditions to a handful of (tanking) numbers

Automobile Industry

The automobile industry has always been very sensitive to economic conditions. Like a canary in the coal mine it symbolized the hardship suffered through recessions and the oil crises, each time shedding large manufacturers and famous brands. Conversely it also rode economic highs to excess, embarking in pet projects that sunk millions of dollars to ultimately deliver failed products.

Missing Pieces

In true capitalist fashion, the collection is meant to grow indefinitely, here are a few targets for acquisitions...