Cynical Capitalist

The portfolio, snapshots of memorabilia and artifacts in the collection

Modern Crashes

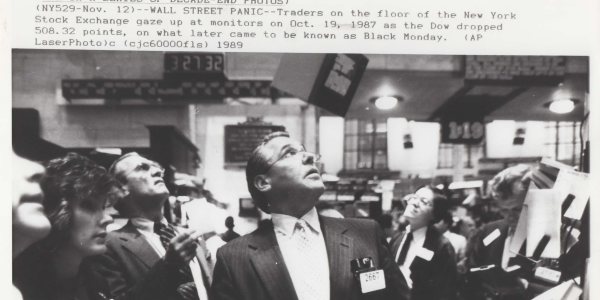

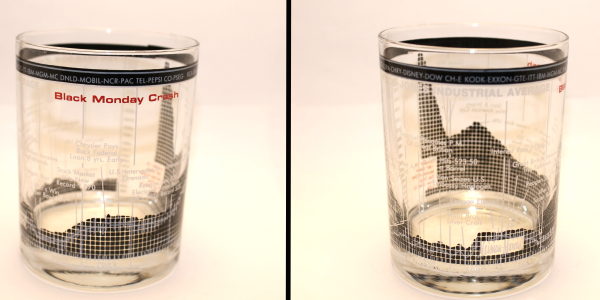

Black Monday (Oct, 19, 1987)

In finance, Black Monday refers to Monday October 19, 1987, when stock markets around the world crashed,

shedding a huge value in a very short time. The crash began in Hong Kongand spread west to Europe, hitting the United States

after other markets had already declined by a significant margin. The Dow Jones Industrial Average (DJIA) dropped by 508 points

to 1738.74 (22.61%).

1997 Mini Crash

The October 27, 1997 mini-crash is the name of a global stock market crash that was caused by an economic crisis in Asia.

This crash is considered a "mini-crash" because the percentage loss was relatively small

compared to some other notable crashes. But after the crash, the markets still remained positive for 1997, though the

"mini-crash" may be considered as the beginning of the end of the 1990's economic boom in the United States and Canada.

May 2010 Flash Crash

The May 6, 2010 Flash Crash also known as The Crash of 2:45, was a United States stock market crash on Thursday May 6, 2010

in which the Dow Jones Industrial Average plunged about 1000 points—or about nine percent—only to recover those losses

within minutes. It was the second largest point swing, 1,010.14 points.

The U.S. Securities and Exchange Commission (SEC) issued a report that "portrayed a market so fragmented and fragile that

a single large trade could send stocks into a sudden spiral," and detailed how a large mutual fund firm selling an unusually

large number of E-Mini S&P 500 contracts first exhausted available buyers, and then how high-frequency traders (HFT)

started aggressively selling, accelerating the effect of the mutual fund's selling and contributing to the sharp price declines that day.