Cynical Capitalist

The portfolio, snapshots of memorabilia and artifacts in the collection

Creative Accounting

WorldCom (2002)

WorldCom's bankruptcy filing in 2002 was the largest such filing in U.S. history.

The WorldCom scandal is regarded as one of the worst corporate crimes in history, and several

former executives involved in the fraud faced criminal charges for their involvement.

Most notably, company founder and former CEO Bernard Ebbers was sentenced to 25 years in prison,

and former CFO Scott Sullivan received a five-year jail sentence.

Under the bankruptcy reorganization agreement, the company paid $750 million to the Securities &

Exchange Commission in cash and stock in the new MCI, which was intended to be paid to wronged investors.

Phar-Mor (1994)

The Phar-Mor discount drug chain became enormously successful in the late 1980's and CEO Michael Monus

became the rising star of retail.

Sam Walton once called Monus the only retailer that he feared, since he couldn't understand how Phar-Mor

grew so rapidly in a short time.

But in July 1992, board members alleged that financial books stored at the corporate headquarters showed

that the company had inflated its profits by huge margins. It would be considered one of the largest frauds

in US history.

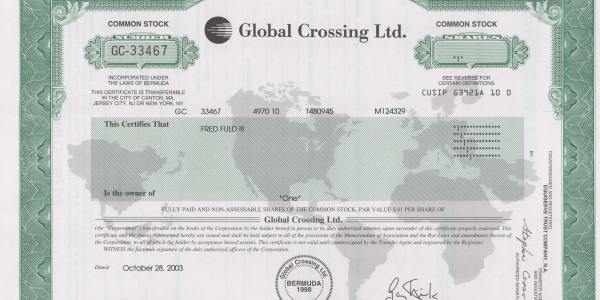

Global Crossing (2002)

Global Crossing, A communication services company that filed for bankruptcy protection amid an accounting scandal

where it had allegedly inflated earnings by using capacity swaps, among other things. Capacity swaps are the exchange

of telecommunications capacity between carriers that is booked as revenue without money ever being exchanged.

In early 2002, the Global Crossing bankruptcy was the fourth largest in U.S. history.