Cynical Capitalist

The portfolio, snapshots of memorabilia and artifacts in the collection

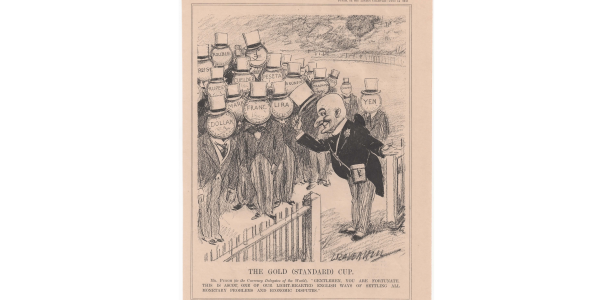

The Gold Standard

On June 5, 1933, the United States went off the gold standard, a monetary system in which currency is backed by gold,

when Congress enacted a joint resolution nullifying the right of creditors to demand payment in gold.

The United States had been on a gold standard since 1879, except for an embargo on gold exports during World War I,

but bank failures during the Great Depression of the 1930s frightened the public into hoarding gold,

making the policy untenable.

Soon after taking office in March 1933, Roosevelt declared a nationwide bank moratorium in order to prevent

a run on the banks by consumers lacking confidence in the economy. He also forbade banks to pay out gold

or to export it. According to Keynesian economic theory, one of the best ways to fight off an economic downturn

is to inflate the money supply. Facing similar pressures, Britain had dropped the gold standard in 1931.

April 5, 1933, Roosevelt ordered all gold coins and gold certificates in denominations of more than $100

turned in for other money. It required all persons to deliver all gold coin, gold bullion and gold certificates

owned by them to the Federal Reserve by May 1 for the set price of $20.67 per ounce.