Cynical Capitalist

The portfolio, snapshots of memorabilia and artifacts in the collection

Backed by metal...

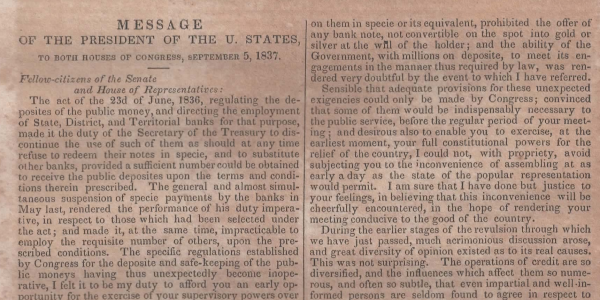

The Panic of 1837 was a financial crisis in the United States built on a speculative fever.

The end of the Second Bank of the United States had produced a period of runaway inflation, but in May 1837,

every bank began to accept payment only in specie (gold and silver coinage), forcing a deflationary backlash.

This was based on the assumption by former president, Andrew Jackson, that the government was selling land for state bank

notes of questionable value.

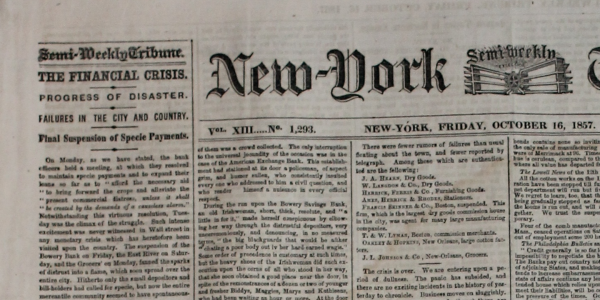

The Panic of 1857 was a financial panic in the United States caused by the declining international economy

and over-expansion of the domestic economy, becoming in the autumn of 1857 the first world-wide economic

crisis. In Britain, the Palmerston government circumvented the requirements of the Peel Banking Act of 1844

which required gold and silver reserves to back up the amount of money in circulation.

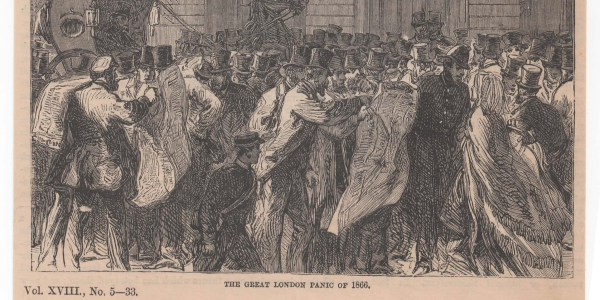

The Panic of 1866 of 1866 was an international financial downturn that accompanied the failure of Overend, Gurney and Company in London, and the corso forzoso abandonment of the silver standard in Italy.