Cynical Capitalist

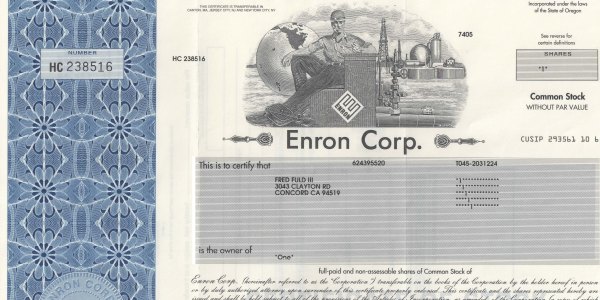

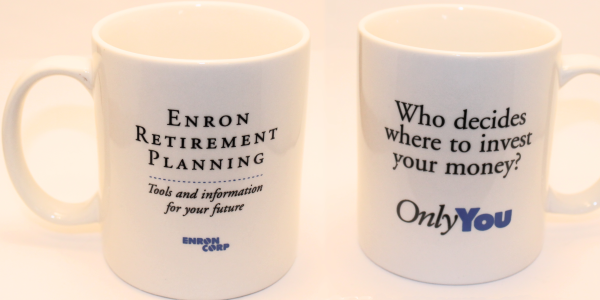

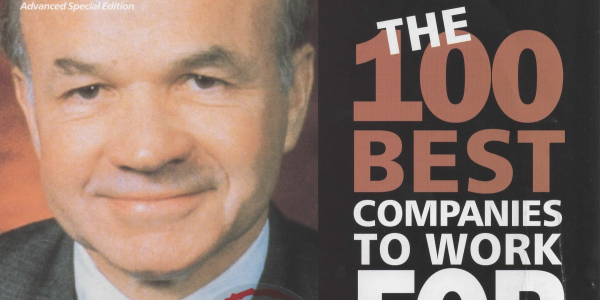

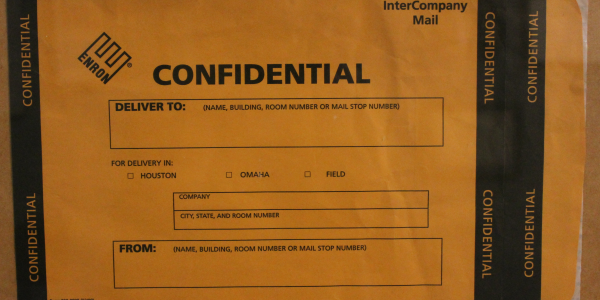

The portfolio, snapshots of memorabilia and artifacts in the collection

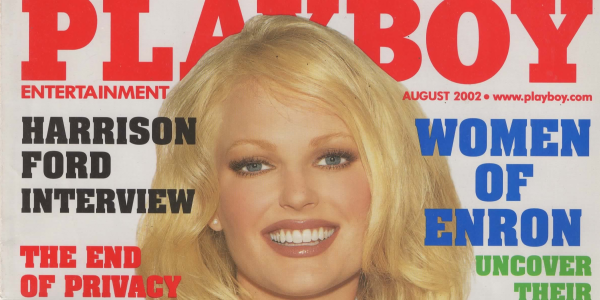

Enron, Ask Why?

The Enron scandal, revealed in October 2001, eventually led to the bankruptcy of the Enron Corporation,

an American energy company based in Houston, Texas, and the dissolution of Arthur Andersen,

one of the five largest audit and accountancy partnerships in the world.

Enron was formed in 1985 by Kenneth Lay after merging Houston Natural Gas and InterNorth.

Shareholders lost nearly $11 billion when Enron's stock price, which hit a high of US$90 per share in mid-2000,

plummeted to less than $1 by the end of November 2001.Enron's $63.4 billion in assets made it the largest

corporate bankruptcy in U.S. history until WorldCom's bankruptcy the following year.

Many executives at Enron were indicted for a variety of charges and were later sentenced to prison.

Enron's auditor, Arthur Andersen, was found guilty in a United States District Court, but by the

time the ruling was overturned at the U.S. Supreme Court, the firm had lost the majority of its customers

and had shut down. As a consequence of the scandal, new regulations

and legislation were enacted to expand the accuracy of financial reporting for public companies.

One piece of legislation, the Sarbanes-Oxley Act, expanded repercussions for destroying,

altering, or fabricating records in federal investigations or for attempting to defraud shareholders.