Cynical Capitalist

The portfolio, snapshots of memorabilia and artifacts in the collection

There's always a greater fool

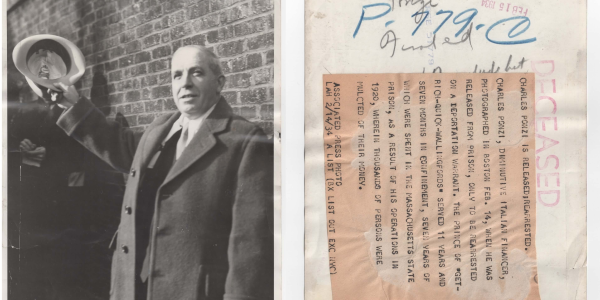

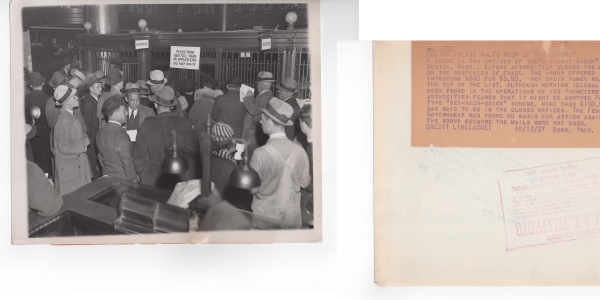

Charles Ponzi was an Italian businessman and con artist in the U.S. and Canada. His aliases include Charles Ponei,

Charles P. Bianchi, Carl and Carlo. Ponzi promised clients a 50% profit within 45 days, or 100% profit within 90

days, by buying discounted postal reply coupons in other countries and redeeming them at face value in the

United States as a form of arbitrage. In reality, Ponzi was paying early investors using the investments of later

investors. This type of scheme is now known as a "Ponzi scheme"

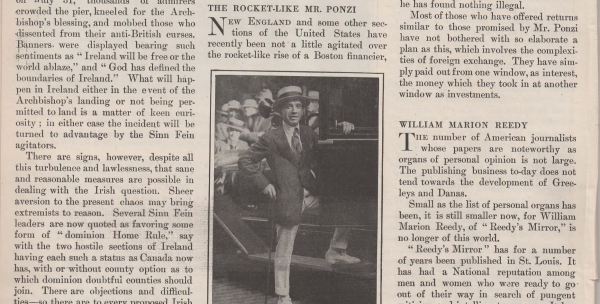

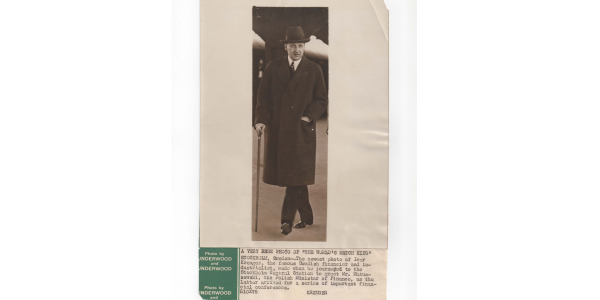

Swedish entrepreneur Ivar Kreuger built a global financial

empire between the two world wars. He negotiated match monopolies with European and South American

governments to control over two thirds of the worldwide match production,

earning him the "Match King" nickname. Kreuger's financial empire was discovered to be a Pyramid scheme when in 1931 rumours

spread that some of his companies empire were financially unstable.

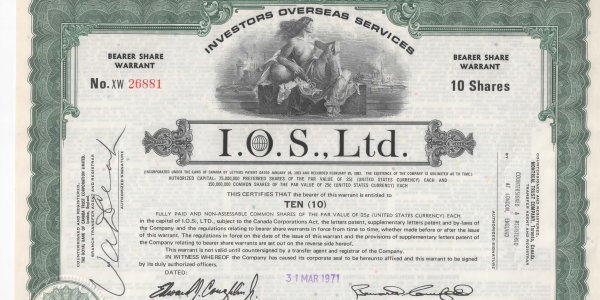

Investors Overseas Services (IOS) was founded in 1955 and sold mutual funds door-to-door all over Europe.

The company raised $2.5bn, but when the market dropped, it kept paying out its "guaranteed returns"

straight out of the capital—in effect, making it a pyramid scheme. Forced into an IPO

to meet its costs, IOS collapsed and ruined a number of US and European banks in 1970.

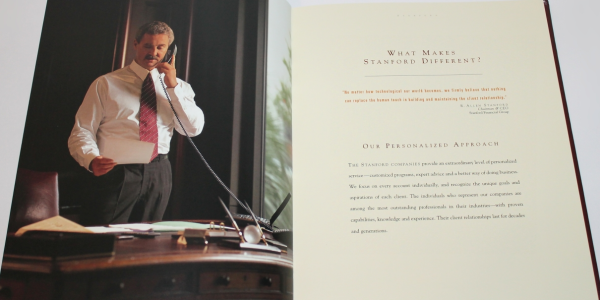

Stanford Financial Group was a privately held group of financial services companies owned by

Allen Stanford, until it was seized by US authorities in 2009. The group had 50 offices, mainly in the Americas,

and managed $8.5bn of assets for more than 30,000 clients in 136 countries

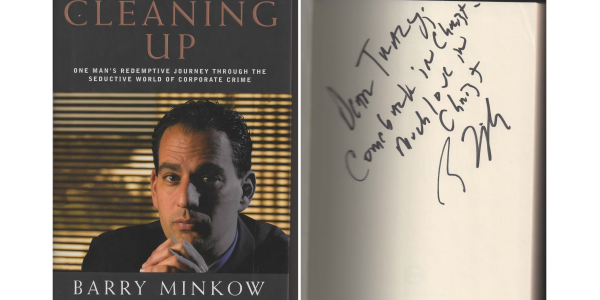

ZZZZ Best appeared to be an successful carpet-cleaning company.

However, it was actually a front to attract investment for a massive Ponzi scheme. It collapsed in 1987, costing investors

and lenders $100 million—one of the largest investment frauds ever perpetrated by a single person, Barry Minkow, as well as one of the largest accounting frauds in history.

The scheme is often used as a case study of accounting fraud.